Loading

Get Cert-109, Partial Exemption For Machinery, Equipment, Or ... - Ct.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the CERT-109, Partial Exemption For Machinery, Equipment, Or ... - CT.gov online

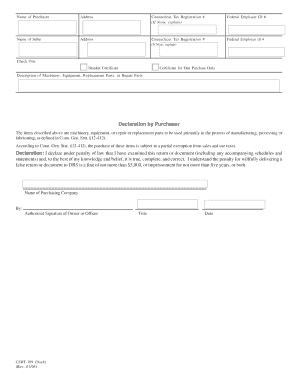

Filling out the CERT-109 form for partial exemption on machinery and equipment can help users save on sales and use taxes. This guide provides clear instructions for each section of the form, ensuring that users can confidently complete it online.

Follow the steps to fill out the CERT-109 form online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering the name of the purchaser in the designated field. This should reflect the legal name of the company or individual making the purchase.

- Next, provide the address of the purchaser, including the street address, city, state, and zip code.

- If the purchaser has a Connecticut tax registration number, enter it in the corresponding field. If not, explain by entering the tax registration number assigned by another state and its name.

- Fill in the federal employer ID number for the purchaser, as required.

- Now, enter the seller’s name and address in the provided fields.

- Similar to the purchaser, include the seller's Connecticut tax registration number. If they do not have one, provide the federal employer ID number instead.

- Choose one of the options by checking the appropriate box: ‘Blanket Certificate’ for ongoing purchases or ‘Certificate for One Purchase Only’ for a single transaction.

- Write a detailed description of the machinery, equipment, or replacement or repair parts being purchased. Be specific to ensure clarity.

- Review the declaration section carefully. This section must be signed by an owner or officer of the business purchasing the items, affirming their primary use in manufacturing, processing, or fabricating as stated in Conn. Gen. Stat. §12-412i.

- Finally, fill in the title of the person signing the certificate and the date of signature. Ensure that all information is accurate to avoid issues.

- Once the form is filled out correctly, save any changes, download a copy for your records, print it if necessary, or share it with relevant parties.

Complete your CERT-109 form online today to take advantage of partial exemptions on your purchases.

Sales Tax Exemptions in Connecticut Several exemptions are certain types of safety gear, some types of groceries, certain types of clothing, children's car seats, children's bicycle helmets, college textbooks, compact fluorescent light bulbs, most types of medical equipment, and certain motor vehicles.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.