Loading

Get Standard European Consumer Credit Information

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the STANDARD EUROPEAN CONSUMER CREDIT INFORMATION online

This guide provides clear, step-by-step instructions on how to complete the STANDARD EUROPEAN CONSUMER CREDIT INFORMATION form online. It is designed to help users understand each section of the form and provide the necessary details accurately.

Follow the steps to complete the form seamlessly.

- Press the ‘Get Form’ button to access the form and open it in your editing platform.

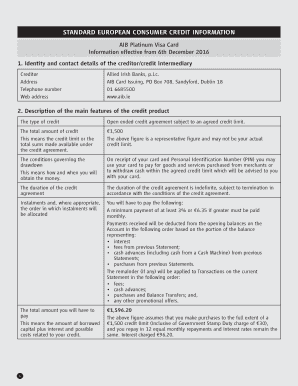

- Enter your identity and contact details along with the creditor's information. This section includes the name, address, telephone number, and website of the creditor or the credit intermediary.

- For the description of the credit product, indicate the type, total amount, conditions for drawdown, and duration of the credit agreement. Ensure to specify the agreed credit limit and any related terms.

- Fill out the costs of the credit. Include details on the annual interest rates for purchases and cash advances, introductory rates if applicable, and the annual percentage rate of charge (APR). Make sure to specify any additional fees associated with the credit.

- Describe the conditions for any related costs and late payments. Explain any associated fees and how they apply in the case of missed payments or exceeding limits.

- Complete the legal aspects section by clarifying the right of withdrawal, early repayment rights, and how consultation of a database regarding the application will be handled.

- Finish by reviewing the additional information regarding distance marketing of financial services as well as the governing laws and rights related to complaints.

- Finally, save your changes, download, print, or share the completed form as necessary.

Begin filling out the STANDARD EUROPEAN CONSUMER CREDIT INFORMATION form online today.

The new Consumer Credit Directive will require Member States to set interest rate caps, annual percentage rate or total credit cost. The draft would also require lenders and credit brokers to ensure that staff members have an appropriate set of skills and knowledge.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.