Loading

Get Vt Form 1 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT Form 1 online

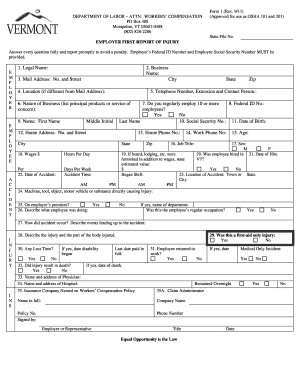

Completing the VT Form 1 online is an essential step in reporting workplace injuries promptly and accurately. This guide provides clear, step-by-step instructions to help you navigate the form with confidence.

Follow the steps to complete the VT Form 1 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the legal name of the employer as well as the business name. Ensure these details are accurate to avoid discrepancies.

- Provide the mailing address including street number, city, state, and postal code. If the location of the business is different from the mailing address, fill out that section as well.

- Fill in the telephone number, including the extension if applicable, and the contact person's name at the organization.

- Indicate whether the employer regularly employs ten or more employees by selecting 'Yes' or 'No'.

- Enter the Federal ID number and the employee’s Social Security number, ensuring confidentiality and accuracy.

- Complete the employee’s name, date of birth, and home address, ensuring all fields are filled out correctly.

- Document the job title, age, and sex of the employee. This information helps in identifying the individual involved.

- Provide details about the wages, hours per day, and days per week for the employee. Include the date and time of the accident.

- Describe the location of the accident, listing the town or city as well as any specific circumstances relevant to the incident.

- Detail the machine, tool, or object that caused the injury, and confirm if the incident occurred on the employer’s premises.

- Clarify what the employee was doing at the time of the accident and describe how the accident occurred.

- Document the nature of the injury, including which part of the body was injured, and indicate whether any lost time occurred due to the incident.

- If the injury resulted in a medical need, enter the name and address of the physician and, if applicable, the hospital.

- Finally, complete the insurance company details, sign the document as the employer or representative, and include the date.

- Once all fields are filled, save your changes, and consider downloading, printing, or sharing the form as necessary.

Take the first step towards better document management by filling out your VT Form 1 online today.

Filing taxes in VT involves filling out VT Form 1, which is the primary tax return for individuals. You can complete this form either online or by mail, depending on your preference. Be mindful of the deadlines and ensure you include all relevant income documents to avoid delays. Should you have any questions during the process, using platforms like uslegalforms provides reliable guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.