Loading

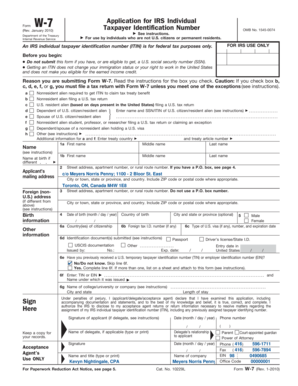

Get W-7 Application For Irs Individual Taxpayer Identification Number Form (rev

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W-7 Application For IRS Individual Taxpayer Identification Number Form (Rev online)

Filling out the W-7 Application for IRS Individual Taxpayer Identification Number is essential for individuals who are not U.S. citizens or permanent residents. This guide provides a step-by-step walkthrough to help ensure that your application is completed accurately and efficiently.

Follow the steps to complete your W-7 application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by selecting the reason for submitting Form W-7. Carefully read the instructions associated with each box and check the appropriate one based on your situation: a) nonresident alien requiring an ITIN to claim a tax treaty benefit, b) nonresident alien filing a U.S. tax return, c) U.S. resident alien filing a U.S. tax return, d) dependent of a U.S. citizen or resident alien, e) spouse of a U.S. citizen or resident alien, f) nonresident alien student, professor, or researcher filing a U.S. tax return, g) dependent or spouse of a nonresident alien holding a U.S. visa, or h) other (details provided in the instructions).

- Enter the applicant's name in fields 1a and 1b. This includes the first name, middle name, last name, and name at birth if it differs from the current name. You should be thorough to ensure consistency with identification documents.

- Fill out your mailing address in section 2. Include a street address, apartment number if applicable, city or town, state or province, and postal code. If your mailing address differs from your foreign address, also complete section 3.

- Provide your date of birth, country of birth, and optionally city and state or province of birth in section 4.

- Complete section 6 by indicating your country or countries of citizenship and foreign tax identification number if applicable. Also, provide information regarding any U.S. visa you may hold, including its type, number, and expiration date.

- In section 6f, if you have previously received a U.S. temporary taxpayer identification number (TIN) or employer identification number (EIN), enter that information as required. If not, you can skip to section 6g.

- Insert the name of the college or university or company associated with section 6g along with its city and state.

- Sign and date the application in the 'Sign Here' section, ensuring the signature matches the name provided in section 1. If someone is signing on behalf of the applicant, that person's details must be filled in accordingly.

- Review the completed form for accuracy. Save changes, download a copy for your records, print the form, or share it as necessary.

Start completing your W-7 application online today to ensure you receive your Individual Taxpayer Identification Number.

Submitting the form A tax return accompanied by one or more W-7 forms cannot be submitted electronically. You can submit it in person at any IRS Taxpayer Assistance Center that performs in-person document reviews; most major cities have such assistance centers, and there is at least one center in every state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.