Loading

Get H&r Block Expat Tax Services One H&r Block Way Kansas City ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the H&R Block Expat Tax Services Client Service Agreement online

Filling out the H&R Block Expat Tax Services Client Service Agreement (CSA) online can be a seamless experience when you follow the right steps. This guide provides clear and detailed instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete your form accurately.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

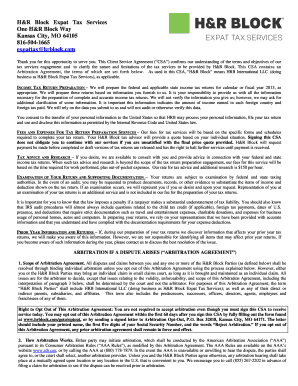

- Read the introductory section to understand the terms of service, which includes details about the income tax return preparation, fees, and responsibilities.

- Fill out your personal information in the designated fields to ensure accurate identification.

- Provide information regarding your income earned in each foreign country and any foreign taxes paid as required in the appropriate sections.

- Review the fees outlined for tax return preparation services and ensure you understand the payment process.

- If you would like tax advice and research beyond return preparation, note that additional fees will apply and should be documented.

- Read through the Arbitration Agreement section carefully to understand your rights in case any disputes arise.

- Sign the CSA in the designated signature areas to confirm your agreement with the terms. If applicable, include your partner's signature.

- Choose whether to allow H&R Block to establish a secure client portal for storing your tax returns by initialing your preference.

- Once all fields are filled and reviewed, save your changes, and then download, print, or email the completed form as necessary.

Start your online document management process now by filling out the H&R Block Expat Tax Services CSA!

If you are a non-resident who has received income from employment or a business in Canada, you will need to file the standard T1 income tax package. You will need to complete Form T2203 as well if you also received additional types of Canadian income other than from employment or business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.