Loading

Get Ny Per 22 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY PER 22 online

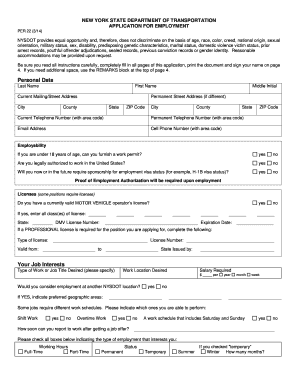

The NY PER 22 form is essential for individuals seeking employment with the New York State Department of Transportation. This guide aims to provide clear, step-by-step instructions for filling out the form online, ensuring a smooth application process.

Follow the steps to fill out the NY PER 22 form online.

- Click the 'Get Form' button to obtain the form and open it in your preferred editor.

- Begin by filling in your personal data, including your last name, first name, middle initial, current mailing address, permanent address, telephone numbers, and email address.

- Provide your employability information, answering whether you require a work permit, are authorized to work in the United States, or need sponsorship for an employment visa.

- If applicable, indicate whether you possess a currently valid motor vehicle operator's license and provide details such as class(es) of license, DMV license number, and expiration date.

- Specify your job interests by listing the type of work or job title desired, preferred work location, and salary requirements. Indicate your availability for different work schedules.

- Complete the education section by entering the name and location of each school attended, degrees earned, and relevant training or certificates.

- For employment experience, list your job history starting from your current or most recent position, detailing duties, responsibilities, and explaining any gaps in employment.

- Disclose information regarding employment of relatives by NYSDOT, if applicable. Include the relative’s name, relationship to you, and their job details.

- Answer additional questions regarding past employment experiences, criminal history, and other relevant matters as specified in the form.

- Add any remarks in the provided section, ensuring all information is complete and accurate before saving your changes.

- Finally, download, print, and sign your completed application on page 4. Once done, you can share the form as required.

Start filling out the NY PER 22 form online today to take the first step towards your employment with NYSDOT.

New employees in New York typically need to fill out the W-4 form to denote their federal tax withholding allowances and the IT-2104 form for state tax withholding. Be sure to follow the NY PER 22 guidelines to ensure that you complete these forms correctly. Properly submitted forms help avoid issues with tax withholding and contribute to a smoother onboarding process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.