Loading

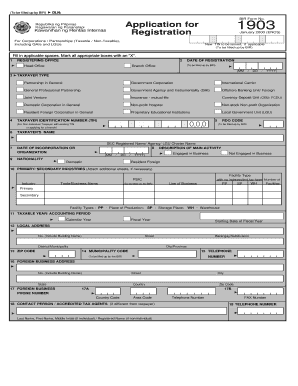

Get Bir Form 1903

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir Form 1903 online

Filling out the Bir Form 1903 online is a crucial step for corporations and partnerships to officially register with the Bureau of Internal Revenue. This guide provides clear and detailed instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the Bir Form 1903 online.

- Click 'Get Form' button to obtain the online version of the Bir Form 1903. This will open the form for you to begin filling it out.

- Fill in your registering office details, indicating whether it is a head office or branch office.

- Enter the date of registration in the format MM/DD/YYYY, as requested in the form.

- Select the appropriate type of organization from the list provided, marking with an 'X'.

- Input your taxpayer identification number (TIN) if applicable for non-individual taxpayers.

- Provide the taxpayer's name, ensuring accuracy for the registration process.

- Specify the date of incorporation or organization, also in the format MM/DD/YYYY.

- Enter the revenue district office (RDO) code, to be filled by the BIR.

- Describe the main activity of the business or organization for which the registration is being made.

- Indicate the taxpayer type—whether engaged in business or not engaged in business.

- List the primary and secondary industries, attaching additional sheets if necessary.

- Select the taxable year or accounting period, marking whether it is a calendar year or fiscal year and the starting date of the fiscal year if applicable.

- Provide the local address by filling in the complete details, including barangay and city/province.

- Input the municipality code and telephone number as required.

- If applicable, fill in the foreign business address details in the specified fields.

- List the relevant tax types that apply to your organization, choosing only those that are applicable.

- Declare the information is correct, signing over printed name, and ensuring all attachments are complete. Attach copies of any required documents such as SEC registrations or mayor's permits.

- Once finished, save your changes and choose to download, print, or share the completed form.

Complete your Bir Form 1903 online today to ensure compliance and smooth processing.

A person is exempted from capital gains tax if the reason for selling their property is to buy or construct a new property. However, a person has no records of availing of the tax exemption for the last decade.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.