Loading

Get Windermere Bridge Loan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Windermere Bridge Loan online

This guide provides a clear and structured approach to filling out the Windermere Bridge Loan application online. Whether you are familiar with bridge loans or new to the process, this step-by-step guide will help you navigate the application efficiently.

Follow the steps to complete your Windermere Bridge Loan application online.

- Click the ‘Get Form’ button to access the Windermere Bridge Loan application and open it in your preferred document editor. Ensure you are working in a secure environment to protect your personal information.

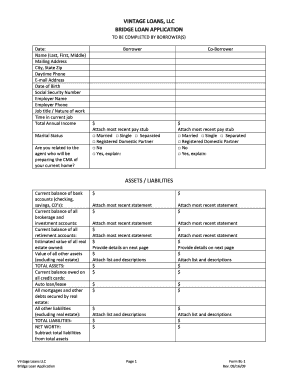

- Begin by filling out the date and your personal information in the designated fields, including your full name, mailing address, phone number, email address, date of birth, and Social Security number. Make sure all information is accurate and current.

- Provide details about your employment, including employer name, job title, nature of work, employment duration, and total annual income. Attach the most recent pay stub as documentation.

- Indicate your marital status and whether you are related to the agent preparing the Comparative Market Analysis (CMA). Provide any explanations if applicable.

- In the assets and liabilities section, input current balances for all bank accounts, brokerage accounts, retirement accounts, and real estate owned. This includes debts secured by the collateral property and other liabilities. Calculate and enter your total assets, total liabilities, and net worth.

- Complete the real estate section by providing information about the collateral property you are borrowing against. Include the property address, type, current mortgage balances, and any other encumbrances. Attach relevant current statements as required.

- In the loan request section, specify the amount you wish to borrow, along with the address of the new property you plan to purchase, the purchase price, estimated closing date, and information about your agent.

- Review the verification section, which requires your signatures. Ensure that all information is true and correct before signing and dating the application.

- Once completed, ensure you attach any required documentation, including pay stubs, bank statements, and proof of insurance. Do not submit the application to your agent for privacy reasons; return it directly to Vintage Loans, LLC.

- After submitting your application, await confirmation from Vintage Loans. If you have questions during the process, contact their office directly for assistance.

Complete your Windermere Bridge Loan application online today for a seamless borrowing experience.

Credit Requirements Since the sale of the current property will automatically pay off the bridge loan, the lender can be reasonably certain they will recoup the loan amount. A credit score of 650 and above should be easily approved by private money bridge lender.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.