Loading

Get Il Dol Il452wc01 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL DoL IL452WC01 online

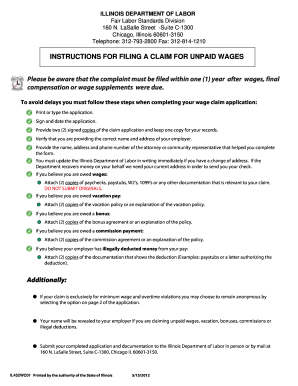

The IL DoL IL452WC01 is a crucial form used for filing a claim for unpaid wages with the Illinois Department of Labor. This guide will provide you with step-by-step instructions on how to accurately complete the form online, ensuring a smooth filing process.

Follow the steps to complete the IL DoL IL452WC01 online successfully.

- Click ‘Get Form’ button to obtain the form and access it for editing.

- Begin by entering your employee information in the designated fields. Fill in your last name, first name, and middle name as well as your contact details.

- Next, provide your employer’s information, including the business name, business owner(s) name(s), business address, and telephone number.

- Under complaint information, fill in the date of hire and last day worked. Answer questions regarding employment status and whether you performed work in Illinois.

- Indicate if you are currently employed by the same employer and whether a temporary staffing agency is applicable.

- In the wages section, check all applicable boxes for unpaid wages, vacation pay, bonuses, commissions, or illegal deductions. Provide relevant details for each claim.

- Attach two copies of supporting documentation relevant to your claims, such as paychecks or agreements. Ensure you do not submit original documents.

- Include your signature and the date at the end of the application to certify the accuracy of the information provided.

- Review all fields for completeness and accuracy before submitting the form.

- Once the form is correctly filled out and verified, you can save your changes, download the form, and print or share it as necessary.

Complete your documents online today to ensure you receive the wages owed to you.

Filling out an Illinois withholding form involves entering your name, Social Security number, and the appropriate number of allowances. Carefully consider your tax situation, as your selections will affect your withholding amount. Ensure that all information is current to avoid any complications later. The IL DoL IL452WC01 provides useful insights for completing this form effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.