Loading

Get Ca Pers-bsd-369-d 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA PERS-BSD-369-D online

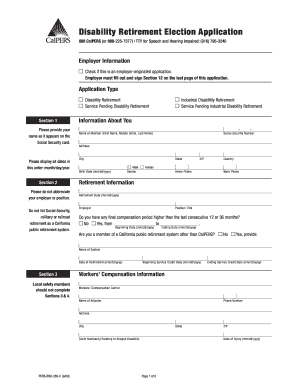

Completing the CA PERS-BSD-369-D, also known as the Disability Retirement Election Application, requires careful attention to detail. This guide provides step-by-step instructions to help you fill out the form accurately and effectively, ensuring a smooth submission process.

Follow the steps to complete your application online.

- Use the ‘Get Form’ button to access the CA PERS-BSD-369-D and open it in your editor.

- Begin by providing your personal information in Section 1. This includes your name as it appears on your Social Security card, your Social Security number, address, date of birth, and gender. Ensure all dates are formatted as month/day/year.

- Complete Section 2, which requires information regarding your retirement, including your employer, position title, and retirement date. Clearly state the details without abbreviations.

- In Section 3, if applicable, provide information related to your beginning and ending service credit dates. Local safety members should skip this section.

- Section 4 pertains to your disability information. Describe the nature of your disability, when it occurred, and any limitations it imposes on your work. Include details about your treating physician.

- Complete Section 5 by selecting your retirement payment option and designating your beneficiary. Make sure to include all necessary sections based on your chosen option.

- If required, fill out Section 6, designating a beneficiary for the Retired Death Benefit. Ensure that you provide accurate information including name and relationship.

- Answer the questions in Section 7 regarding your marital status, partnership, and dependents. Provide additional details as necessary.

- In Section 8, indicate your last day on payroll.

- If applicable, guarantee that Section 9 is completed by your employer. This section must be signed by the employer if the application is employer-originated.

- Proceed to Section 10 to address tax withholding preferences. Provide necessary selections based on your situation.

- In Section 11, ensure that you sign the document. Notarization may be required, particularly if required signatures are not available.

- Finally, review all completed sections for accuracy. Save your changes, then download, print, or share the form as needed.

Complete your CA PERS-BSD-369-D application online for a streamlined experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The CalPERS retirement formula 2% at 62 refers to a method for calculating pensions for members who retire at 62 years of age. It means you earn 2% of your final compensation for each year of service. This formula assists retirees in planning their financial future, making understanding CA PERS-BSD-369-D very beneficial.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.