Loading

Get Ca Edd De 6 2004-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA EDD DE 6 online

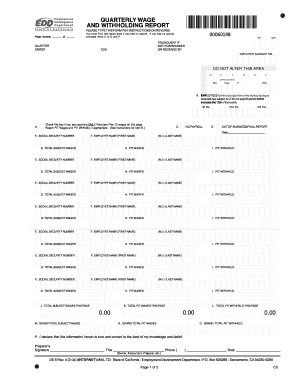

Completing the CA EDD DE 6 form online can streamline the process of reporting wages and withholdings for your employees. This guide will provide you with detailed, step-by-step instructions to ensure you fill out the form correctly and efficiently.

Follow the steps to successfully complete your CA EDD DE 6 form online.

- Click ‘Get Form’ button to access the CA EDD DE 6 form and open it in your preferred editor.

- Review the information required for the quarter and year. Ensure you have all necessary data ready before beginning.

- Complete the quarter ended section, specifying the year and quarter accurately.

- Enter your employer account number in the designated field to link your report to your business.

- In section A, indicate the number of employees who worked during or received pay that is subject to unemployment insurance for the payroll period that includes the 12th of the month.

- If applicable, check the box in section B to report only voluntary plan disability wages, and provide any necessary information for PIT wages and withholding.

- If there was no payroll during the reporting quarter, check the box in section C. Ensure you enter zeroes in relevant fields.

- If this is your final report or if your business is out of operation, check the box in section D and provide the closure date.

- In sections E and F, enter the social security number and the names of each employee to whom wages were paid.

- Proceed to section G, where you'll enter the total subject wages paid to each employee during the quarter, followed by PIT wages in section H and any PIT withheld in section I.

- On the last page (or the required page), ensure you compile and enter the grand totals for sections M, N, and O.

- Finally, sign in section P, stating your title, phone number, and the date to validate your report.

- Once you have completed all sections, save your changes, and you can choose to download, print, or share the completed form as needed.

Complete your CA EDD DE 6 form online today to ensure timely and accurate reporting.

Filing a claim for EDD is done through the California EDD website or by phone. You will need to provide specific information about your employment history and earnings. Remember, timely filing is crucial to ensure you receive benefits without delays linked to claims associated with the CA EDD DE 6.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.