Loading

Get How To Fill Out 4506 T Sample

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Fill Out 4506 T Sample online

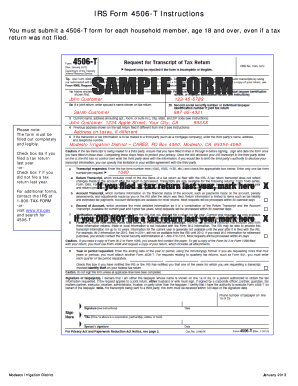

Filling out the IRS Form 4506-T is an essential step for users seeking to obtain a transcript of their tax return or verify income information with the IRS. This guide will provide clear, step-by-step instructions on completing the form online, ensuring a smooth and efficient experience.

Follow the steps to successfully complete the 4506-T form online.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Begin by filling out your name in the first line. Make sure to enter the name of the person who is requesting the tax information, as it appears on their tax return.

- In the next section, provide your Social Security number in the space designated. If you are requesting information for more than one person, include their Social Security numbers in the appropriate fields as well.

- Complete the address section by entering the address used on your most recent tax return. If your address has changed, fill in the new address clearly and correctly.

- Check the appropriate box in section 6a if you filed a tax return for the previous year. If you did not file, mark box 7 instead.

- Indicate the purpose of the request by selecting the relevant box. This helps the IRS understand why you are requesting the form.

- For box 9, indicate the calendar year or years you are requesting the transcript for by entering the year information in the space provided.

- Complete the signature section by signing and dating the form. Ensure all signatures are from individuals whose names are listed on the form.

- Once all sections are completed, you may review the form for accuracy before saving changes, downloading, printing, or sharing the form as needed.

Take the next step towards managing your tax information by completing your 4506-T form online today.

0:28 2:40 Check off you'll have the authority to sign the 4506t. Provide a phone number where you can beMoreCheck off you'll have the authority to sign the 4506t. Provide a phone number where you can be reached. And sign and date the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.