Loading

Get Wi Form 1952 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI Form 1952 online

Filling out the WI Form 1952 online can be straightforward with the right guidance. This guide is designed to provide clear and detailed steps to help you successfully complete the form with confidence.

Follow the steps to complete the WI Form 1952 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

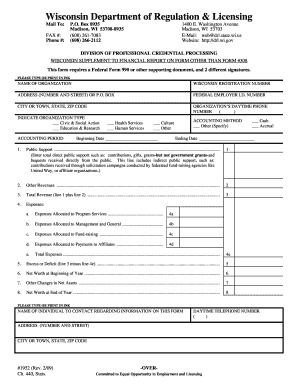

- Enter the name of your organization in the designated field. Ensure that you type this information clearly, as it is crucial for identifying your entity.

- Input the Wisconsin registration number assigned to your organization. This number helps in tracking and verification.

- Fill in the address of your organization, including street number, street name, or P.O. Box, and then provide the city, state, and ZIP code.

- Enter your organization's Federal Employer I.D. number in the appropriate field. This number is essential for tax purposes.

- Include the daytime phone number of your organization so that you can be reached if necessary.

- Indicate the type of organization by selecting the appropriate checkbox, such as Civic & Social Action, Education & Research, Health Services, Human Services, Culture, or Other. If you select 'Other,' please specify.

- Specify the accounting period by entering the beginning and ending dates. Ensure that these dates accurately reflect your fiscal year.

- Complete the financial sections by entering the total public support, other revenues, and calculating total revenue by adding the previous two amounts. Also, provide detailed expense allocations and total expenses in their respective fields.

- Calculate the excess or deficit by subtracting total expenses from total revenue.

- Fill in the net worth at the beginning and end of the year, along with any other changes in net assets.

- Provide the name and daytime telephone number of a contact person regarding information on this form.

- Address any additional questions, such as those relating to contributions received, changes in organizational particulars, and attach necessary documents or explanations as required.

- Complete the certification section, ensuring that both required signatures are provided. Date the form appropriately.

- After reviewing the entire form for accuracy, save your changes, and choose to download, print, or share the completed form as needed.

Complete your documents online today for a smooth filing experience!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Failing to file Form 990 can lead to significant consequences, including penalties and the potential loss of tax-exempt status for your nonprofit. The IRS may impose fines for late filings, and prolonged non-compliance can result in automatic revocation of your organization’s tax-exempt status. To avoid these issues, it is critical to stay organized and submit your forms on time. Resources like USLegalForms can help you stay on track with your filing obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.