Loading

Get Tamu Hotel Tax Exemption Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TAMU Hotel Tax Exemption Form online

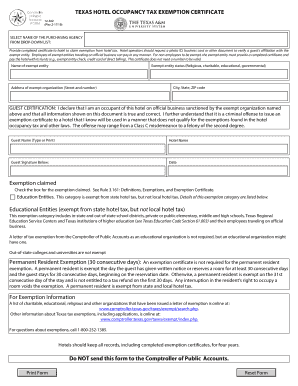

Filling out the TAMU Hotel Tax Exemption Form online can simplify the process of claiming hotel tax exemptions for eligible users. This guide provides clear instructions to help you complete the form accurately.

Follow the steps to successfully complete your exemption form.

- Click 'Get Form' button to obtain the form and open it in the online editor.

- Select the name of the purchasing agency from the provided drop-down list. This is essential for identifying the entity that qualifies for the exemption.

- Fill in the name of the exempt entity in the designated field. Ensure that the name is accurate to validate the exemption.

- Indicate the exempt entity status, choosing from options such as religious, charitable, educational, or governmental based on your organization’s classification.

- Provide the address of the exempt organization, including the street address, city, state, and ZIP code. This information should accurately reflect the organization's registered location.

- In the guest certification section, type or print the guest's name, hotel name, and the date. The guest should also sign the form below this section, certifying their status as an occupant on official business.

- Check the box next to the exemption claimed, referring to the appropriate category that applies. Familiarize yourself with the exemptions related to educational entities or other qualifying groups.

- Verify all the details entered for accuracy. Double-check the information against official documents to ensure compliance.

- Once all sections are completed and verified, save your changes, and download the form. You may also choose to print or share it as needed.

Complete your TAMU Hotel Tax Exemption Form online today to ensure your tax exemption is processed efficiently.

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.