Loading

Get Save A Copy 01-339 (rev

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SAVE A COPY 01-339 (Rev online

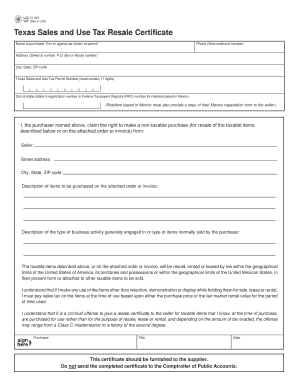

Filling out the SAVE A COPY 01-339 (Rev) form is an essential step for individuals and businesses looking to manage tax-exempt purchases efficiently. This guide will provide you with clear, step-by-step instructions to ensure you complete the form correctly and comply with relevant regulations.

Follow the steps to fill out the SAVE A COPY 01-339 (Rev)

- Click ‘Get Form’ button to access the SAVE A COPY 01-339 (Rev) form. This will allow you to open the document in an online format for editing.

- Fill in the name of the purchaser, firm, or agency in the designated section as it appears on the permit. It is vital to ensure this information is accurate to avoid complications with tax authorities.

- Enter the phone number, including the area code, in the appropriate field to ensure you can be contacted for any queries regarding the transaction.

- Complete the address section with the street address, P.O. Box, or route number. Be sure to include the city, state, and ZIP code for proper identification.

- Input your Texas Sales and Use Tax Permit Number, which must contain exactly 11 digits. This is a crucial element that validates your exemption claim.

- If applicable, provide the out-of-state retailer's registration number or the Federal Taxpayers Registry (RFC) number for any retailers based in Mexico. This section is necessary to maintain clarity in cross-border transactions.

- Describe the items to be purchased as shown on the attached order or invoice. Be as specific as possible to ensure the form fulfills its purpose.

- In the following fields, explain the type of business activity you are generally engaged in or the type of items you normally sell. This section provides context for the resale claim.

- Review your entries for accuracy. Ensure all information is complete and correctly reflects your intentions regarding tax-exempt purchases.

- Once you have filled out the form, save your changes. You may download, print, or share the completed document as needed. Remember to provide it to the supplier and do not submit it to the Comptroller of Public Accounts.

Start completing your SAVE A COPY 01-339 (Rev online for efficient tax management.

The resale certificate is the seller's evidence as to why sales tax was not collected on that transaction and should be retained in the seller's books and records for four years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.