Loading

Get Section 125 Cafeteria Plan Interest Form For Current Plan ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Section 125 Cafeteria Plan Interest Form for current plan year online

Understanding the Section 125 Cafeteria Plan Interest Form is essential for users looking to manage their pre-tax benefits effectively. This guide provides step-by-step instructions on how to fill out the form online, ensuring a smooth and informed experience.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your designated document editor.

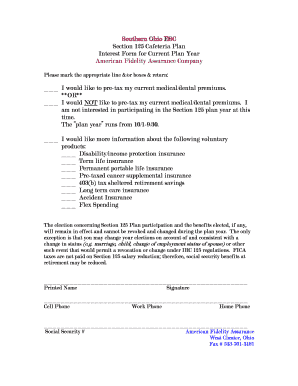

- Begin by reviewing the initial statement regarding your preference to pre-tax your current medical or dental premiums. Mark the corresponding box based on your choice: either to participate in pre-taxing or to decline participation.

- Note the plan year's duration, which runs from October 1 to September 30, to ensure your elections are consistent with the plan schedule.

- If you would like further information on voluntary products, please check the appropriate boxes next to the options listed. These may include options such as disability income protection or long-term care insurance.

- Understand that your election under the Section 125 Plan, including any benefits elected, is effective for the entire plan year. Changes may only occur due to qualifying events per IRC 125 regulations.

- Provide your printed name, signature, and relevant contact information, including your cell phone, work phone, and home phone, to ensure proper identification and communication.

- Remember to include your social security number for verification purposes while ensuring your data is kept secure.

- Once you have filled out all sections of the form, save your changes, and proceed to download, print, or share the completed form as needed.

Complete your Section 125 Cafeteria Plan Interest Form online today to manage your benefits effectively.

A Cafeteria Plan lets employees receive certain tax benefits. Specifically, employees are able to use a plan to pay for approved expenses with pre-tax dollars, thus saving them from paying taxes on the money put into their Cafeteria Plan. These plans are sometimes referred to as Section 125 Plans or Cafeteria Plans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.