Loading

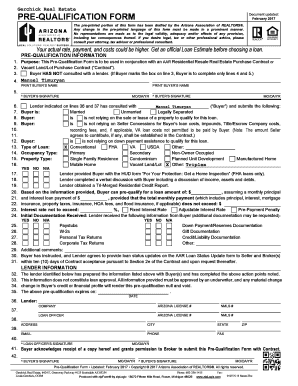

Get Purpose: This Pre-qualification Form Is To Be Used In Conjunction With An Aar Residential Resale

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Purpose: This Pre-Qualification Form Is To Be Used In Conjunction With An AAR Residential Resale online

Filling out the pre-qualification form is an essential step for buyers looking to engage in a residential resale transaction. This guide provides a detailed overview of how to accurately complete this form to ensure a smooth process. Follow these steps carefully to submit your pre-qualification information online with confidence.

Follow the steps to successfully complete the pre-qualification form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by providing your full name in the designated field labeled 'Print buyer’s name'. This information is crucial for identifying the primary participant in the transaction.

- Indicate whether you have consulted with a lender by checking the appropriate box. If you have not, proceed to complete only the specified lines.

- If applicable, select your marital status as either married, unmarried, or legally separated.

- Next, specify whether you are relying on the sale or lease of a property, or on seller concessions for covering loan costs.

- Choose the type of loan you are applying for from the given options such as conventional, FHA, VA, USDA, or others.

- Select the occupancy type, whether it be primary, secondary, or non-owner occupied.

- Identify the type of property you are interested in, including options like single family residence, condominium, or vacant land.

- As you fill out the form, any required documentation, such as paystubs or tax returns, should be indicated in the respective sections.

- Once all required fields are complete, review thoroughly for accuracy, then save, download, print, or share the form as necessary.

Complete your pre-qualification form online today to take the next step in your residential resale journey!

Related links form

Pre-qualifying is just the first step. It gives you an idea of how large a loan you'll likely qualify for. Pre-approval is the second step, a conditional commitment to actually grant you the mortgage.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.