Loading

Get Monthly Value-added Tax Declaration - Bureau Of Internal Revenue - Ftp Bir Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

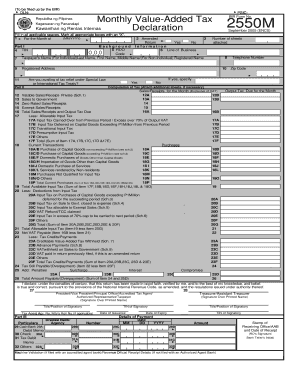

How to fill out the Monthly Value-Added Tax Declaration - Bureau Of Internal Revenue - Ftp Bir Gov online

This guide provides clear and supportive instructions on how to successfully complete the Monthly Value-Added Tax Declaration. Users of all experience levels will benefit from detailed steps and explanations of each form component, ensuring an efficient filing process.

Follow the steps to accurately complete your Monthly Value-Added Tax Declaration online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin filling out the form by entering your Tax Identification Number (TIN) in the appropriate field. Ensure that you enter the correct 12-digit TIN for accurate processing.

- Specify the month and year for which you are filing the return by selecting the appropriate MM/YYYY format.

- Indicate whether you are filing an amended return by marking 'Yes' or 'No' in the corresponding box.

- Fill in your name or registered name, depending on whether you are filing as an individual or non-individual. Ensure accuracy in spelling and format.

- Enter your registered address, including the zip code and telephone number to maintain communication with the Bureau of Internal Revenue.

- In Part II of the form, provide the required sales and receipts amounts, ensuring that the totals are calculated excluding VAT. Include details for private sales, sales to the government, zero-rated sales, and exempt sales.

- Calculate your allowable input taxes by providing the necessary breakdown of input tax carried over from previous periods and current transactions.

- Complete the deductions from input tax section as necessary, providing accurate figures to avoid discrepancies.

- Determine the net VAT payable by subtracting total allowable input tax from total sales/receipts and output tax due.

- Finalize your submission by signing the declaration, confirming the truthfulness of the information provided, and noting the date of issuance.

- After completing the form, save your changes, then download, print, or share the completed declaration as required.

Complete your Monthly Value-Added Tax Declaration online for a smooth filing experience.

The government collects a 12% VAT on goods consumed within the Southeast Asian country.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.