Get Pr Application Act 22-2012 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR Application Act 22-2012 online

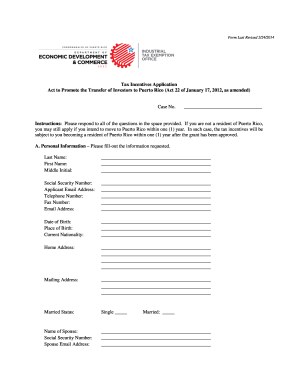

Filling out the PR Application Act 22-2012 online is a vital step for individuals seeking tax incentives to relocate to Puerto Rico. This guide provides comprehensive, step-by-step instructions to assist users in completing the application accurately and efficiently.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to access the online form and open it in your browser.

- Begin by filling out your personal information in Section A. Provide your last name, first name, middle initial, social security number, email address, telephone number, fax number, date of birth, place of birth, and current nationality. Make sure your information is accurate.

- Indicate your home address and mailing address if different. Be thorough and double-check the details to avoid any delays.

- Inquire about your marital status and provide details if applicable, including the name and social security number of your spouse. Specify if your spouse will also be requesting exemption under Act 22.

- Proceed to Section B to fill in the applicant's representative details if applicable. Provide their personal information, including name, address, and contact details.

- In Section C, confirm your residency history. Clearly indicate if you have been a resident of Puerto Rico during the last fifteen years prior to the effective date of Act 22-2012.

- For Puerto Rico residency, specify your current residency status and date of residency. If not a Puerto Rico resident, provide your current place of residency.

- In Section D, outline your background and professional information. State your current profession and attach your curriculum vitae as directed.

- In Section E, provide financial information, including your approximate net worth and investment plans in Puerto Rico. Answer all questions carefully, as they are for informational purposes.

- Complete Section F regarding any criminal history or relevant legal issues. Notification of any such issues is mandatory in writing.

- Submit your application. You can send a PDF copy via email to the designated address or mail the original copy to the appropriate office.

- Finally, sign the application in Section G, including the date, to confirm the accuracy of your submission.

Start filling out your PR Application Act 22-2012 online today and take the first step towards your relocation benefits!

To qualify for the benefits under the PR Application Act 22-2012, individuals must meet residency requirements and not have been residents of Puerto Rico for the past ten years. This typically includes affluent individuals and investors who make Puerto Rico their primary home. Understanding the qualifications is essential, and services like uslegalforms can assist with the application process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.