Loading

Get Pa Sec-1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA SEC-1 online

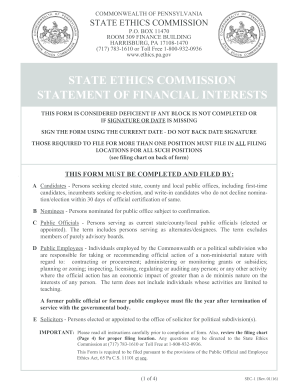

The PA SEC-1 form, also known as the statement of financial interests, is a crucial document required by public officials and elected candidates in Pennsylvania. This guide will provide clear, step-by-step instructions to help you navigate the form with confidence.

Follow the steps to successfully complete the PA SEC-1 form online.

- Click ‘Get Form’ button to access the PA SEC-1 form and open it in the editor.

- Begin by filling in your personal details in the relevant fields. This includes your last name, first name, middle initial, and any applicable suffix.

- Provide your current business address or a home address, along with a daytime telephone number.

- Indicate your status by checking the appropriate block that corresponds to your role or position.

- List all public positions you are seeking, currently hold, or have held in the prior calendar year. Ensure to include your job titles.

- Fill in information regarding any political subdivisions relevant to your current or previous public positions.

- In the specified block, denote your occupation along with relevant annual income, if required.

- Disclose any real estate interests involved in transactions with governmental entities. If none, indicate 'none'.

- Report creditors and any debts if they exceed the specified amount. Only significant debts are to be disclosed.

- Provide details about your sources of income, including employment and any gifts received during the reporting year.

- Complete any sections regarding transportation, lodging, or hospitality expenses as applicable.

- List any positions of directorship or employment within business entities, ensuring to include any related compensation.

- In the final steps, confirm all provided information is accurate and complete, then use the appropriate buttons to save, download, or print the form.

Complete your PA SEC-1 form online today to ensure compliance and transparency in public service.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Failing to file PA state taxes can lead to penalties, interest on unpaid taxes, and potential legal actions from the state. The PA SEC-1 aims to inform filers about the consequences of non-filing. It’s vital to address any tax obligations promptly to avoid complications. If you need assistance, USLegalForms offers tools to help you navigate tax filing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.