Loading

Get Ca Cba Licensee Reporting Form 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA CBA Licensee Reporting Form online

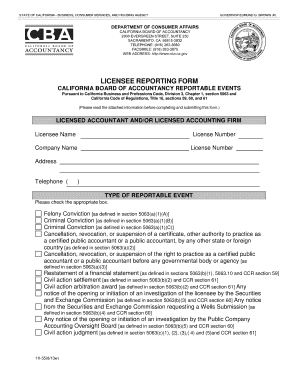

The CA CBA Licensee Reporting Form is essential for licensed accountants and accounting firms to report specific events as mandated by California law. Filling this form online can be straightforward if you follow the outlined steps carefully.

Follow the steps to complete the form accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, provide your licensee name and license number. For accounting firms, include the company name and its license number as well.

- Fill in your current address and a valid telephone number. This personal information is crucial for communication regarding your report.

- Identify the type of reportable event you are addressing by checking the appropriate box. Options include felony conviction, criminal conviction, or any administrative actions.

- In the explanation for reportable event section, summarize the event. If necessary, attach additional sheets for a detailed explanation.

- If the reportable event involves a financial statement restatement, attach copies of both the original and restated financial statements.

- For civil action settlements or arbitration awards amounting to $30,000 or more, provide the total amounts paid by both the insurer and the licensee along with the corresponding dates.

- If relevant, detail information about administrative agency actions or court actions, including the title of the matter, docket number, and the names and addresses of the court, arbitrator, or agency.

- Certify the information by signing the form and dating it, acknowledging that the information provided is true and correct to the best of your knowledge.

- Once you have filled out all sections accurately, save your changes. You can then download, print, or share the completed form as needed.

Complete your CA CBA Licensee Reporting Form online today to ensure timely compliance with reporting requirements.

Understanding California CPE Ethics Requirements In California, you're required to earn 80 CPE credits in every 2-year licensing period with a minimum of 20 credits each year. You can earn all these CPE hours for CA by taking self-study courses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.