Loading

Get Md Application For Lien Certificate - Anne Arundel County 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Application For Lien Certificate - Anne Arundel County online

Filling out the MD Application For Lien Certificate online can be a straightforward process with the right guidance. This user-friendly guide will walk you through each step needed to successfully complete the application.

Follow the steps to complete your application with ease.

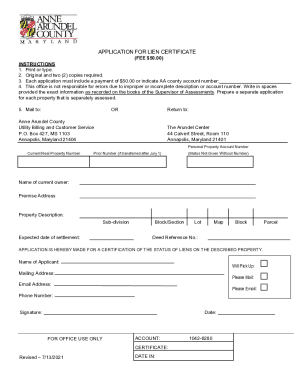

- Press the ‘Get Form’ button to access the application and open it in your preferred online editor.

- Begin filling in your personal details by providing your name as the current owner. Ensure this matches the records maintained by the Supervisor of Assessments.

- Enter the premise address of the property for which you are applying. Be accurate to avoid any delays in processing.

- Provide a thorough description of the property. Include specifics such as subdivision, block or section, lot number, and map block for clarity.

- Indicate the expected date of settlement, as this information is necessary for processing the application.

- Enter your personal property account number, current real property number, and any prior number if applicable, especially if the property was transferred after July 1.

- Complete the application by providing your contact details, including mailing address, email address, and phone number. This allows the office to reach you if additional information is needed.

- Sign the application indicating your agreement and understanding of the information provided.

- Choose to either pick up the certificate in person or have it mailed to you. This choice will affect how you submit the application.

- Finally, save any changes made to the application, and consider downloading or printing a copy for your records before submission.

Complete your application for the Lien Certificate online today for a smoother process.

Baltimore County Transfer Tax Rate—1.5 percent of consideration. State Recordation—$2.50 each $500 (or fraction thereof) of the consideration noted or for an instrument of writing securing a debt or the principal amount of the debt secured.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.