Loading

Get Re-disclosure/change Of Circumstance Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RE-DISCLOSURE/CHANGE OF CIRCUMSTANCE FORM online

This guide provides a step-by-step approach to filling out the RE-DISCLOSURE/CHANGE OF CIRCUMSTANCE FORM online. It emphasizes clarity and accessibility, ensuring that all users can understand the necessary components and processes involved.

Follow the steps to complete the form effectively.

- Click the ‘Get Form’ button to access the document and open it in your preferred editor.

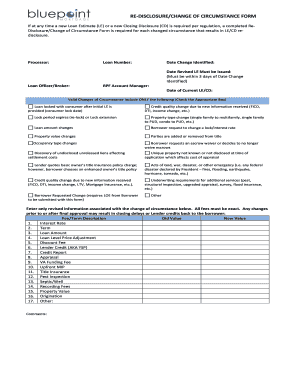

- Begin by entering the Processor's name, the Loan Number, and the Loan Officer/Broker information in the designated fields.

- Next, input the Date Change Identified and the Date Revised Loan Estimate must be issued. Ensure that the revised date falls within three days of the date the change was identified.

- Fill in the RPF Account Manager's name and the Date of the Current Loan Estimate/Closing Disclosure. This data helps maintain accurate records.

- Check the appropriate box for the Valid Changes of Circumstance. These options include various situations such as loan locking revisions, credit quality changes, and property type changes.

- In the section for revised information, only enter the updated details related to the identified change of circumstance. Make sure to specify any changes in fees accurately.

- Fill out all applicable fields in the Fee/Term Description area, detailing Old Value and New Value for each relevant fee, ensuring that all changes are precise.

- Finally, provide any comments or additional notes that could assist in clarifying the changes. Once all information is filled, review thoroughly for accuracy.

- After ensuring that all details are correct, save your changes, and opt to download, print, or share the document as necessary.

Start completing your RE-DISCLOSURE/CHANGE OF CIRCUMSTANCE FORM online today.

Related links form

The three items are: 1) the APR becomes inaccurate (violates tolerances); 2) the addition of prepayment penalty; and, 3) a loan product change. These three items require redisclosure and a new waiting period of three business days prior to the loan closing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.