Loading

Get State Of Nevada Declaration Of Value Form 1. Assessor ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the STATE OF NEVADA DECLARATION OF VALUE FORM 1. Assessor online

Filling out the State of Nevada Declaration of Value Form 1 is an important step in managing property transactions. This guide will provide clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

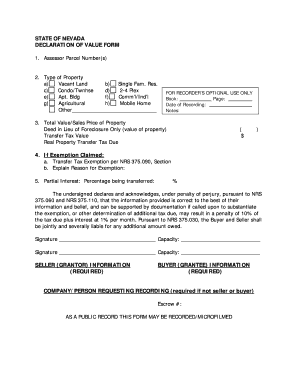

- Begin by entering the Assessor Parcel Number(s) in the designated field. This number uniquely identifies the property in the assessor's records.

- Next, select the type of property from the provided options. This may include categories such as vacant land, single family residence, condominium, two to four plex, apartment building, commercial or industrial, agricultural, mobile home, or other types. Mark the appropriate box clearly.

- Fill in the Total Value/Sales Price of the property in the specified field. If the transaction involves a deed in lieu of foreclosure, include the value of the property. Also, indicate the transfer tax value and the total real property transfer tax due as necessary.

- If claiming an exemption, indicate this by checking the appropriate box. Provide details regarding the transfer tax exemption per NRS 375.090, and explain the reason for the exemption in the space provided.

- Detail the percentage of partial interest being transferred in the respective field. Ensure this value is accurate as it may affect taxation.

- Sign the form in the indicated areas, ensuring that each signer includes their name and capacity. This declaration admits the information provided is true and subject to penalty for any inaccuracies.

- Lastly, provide the required information for the seller and buyer including names, contact details, and escrow number if applicable. Ensure all required sections are completed before finalizing.

- Once all sections have been completed, you can save changes, download a copy for your records, print, or share the form as necessary.

Complete your documents online to ensure smooth property transactions.

Related links form

The County Recorder in the county where the property is located is the agency responsible for the imposition and collection of the tax at the time the transfer is recorded. The Grantee and Grantor are jointly and severally liable for the payment of the tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.