Get Nj R-305 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ R-305 online

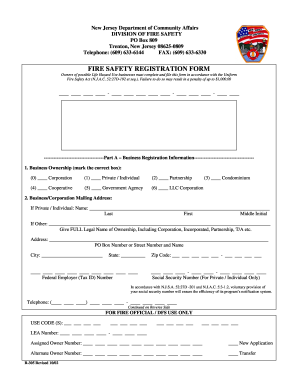

Filling out the NJ R-305 form is a crucial step for owners of businesses classified as Life Hazard Use to maintain compliance with the Uniform Fire Safety Act. This guide provides detailed, user-friendly instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to complete the NJ R-305 online.

- Click ‘Get Form’ button to obtain the registration form and access it in the online editor.

- Begin by filling out Part A – Business Registration Information. Choose the correct box to indicate your business ownership structure, such as Corporation, Private/Individual, or LLC Corporation.

- Enter the Business/Corporation Mailing Address. If you selected Private/Individual, provide your full name, including last, first, and middle initial. If applicable, give the legal name of your business ownership.

- Fill in your address details, including PO Box or street number and name, city, state, and zip code. Be sure to provide your Federal Employer (Tax ID) Number if available.

- If applicable, enter your Social Security Number in the designated field for Private/Individual ownership, keeping in mind that it's voluntary.

- Provide a telephone number where you can be reached.

- Identify the person to receive certified mail or other notices. If this person is the same as the owner, simply write 'Same.' Ensure their address is not a PO Box.

- In the next section, describe the building types, uses, or businesses you own in detail.

- Proceed to Part B – Business Location Information. Fill in the name of the building or business, the physical location, and any suite or room number.

- Complete the building's block number, height, municipality, lot number, number of stories, county, municipal tax account number, square footage, and occupant load.

- In Part C – Certification, sign and date the form, printed your name and title, along with your street address, city, state, zip code, and telephone number.

- Review the form for accuracy, then save your changes. You can download, print, or share the completed form as needed.

Take action today and complete your NJ R-305 online to ensure your compliance with fire safety regulations.

You can expect your NJ rebate check generally within a few weeks after filing your taxes, although timing may vary based on your situation. If you have provided all required information accurately, the process is usually smooth. However, delays can occur, so it's wise to check your status online. To simplify your tax preparation, consider using tools from US Legal Forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.