Loading

Get Tax Map Verification Form - Nassau County

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Map Verification Form - Nassau County online

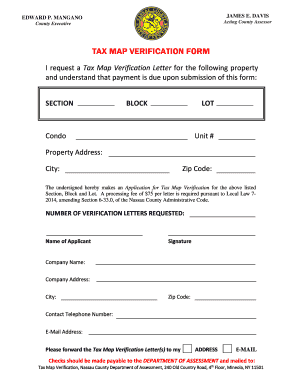

Completing the Tax Map Verification Form for Nassau County online is a straightforward process that ensures your property information is accurately represented. This guide will walk you through each section of the form, providing clear instructions to facilitate your submission.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to retrieve the Tax Map Verification Form and access it for completion.

- Begin filling out the form by indicating the appropriate Section, Block, and Lot number for the property in question. Ensure the entries are accurate as they are crucial for identification.

- If applicable, input the Condo Unit number to specify the exact location of the property within a condominium setup.

- Provide the complete property address, including the city and zip code. Double-check for any typographical errors to avoid processing delays.

- State the number of verification letters you wish to request. Remember that a processing fee of $75 per letter is applicable.

- Fill in the name of the applicant and provide a signature. If you're representing a company, be sure to write the company name and address along with the city and zip code.

- Enter a valid contact telephone number along with an email address to facilitate communication regarding your request.

- Specify how you would like to receive the Tax Map Verification Letter(s) by checking the preferred delivery method: either via physical address or email.

- After completing the form, save the changes. You can then download, print, or share the form as needed for your records or submission.

Take action now by completing your Tax Map Verification Form online to ensure your property is verified and accurately documented.

You may go on to file an appeal using the recent sales you select as support for your requested assessment reduction. If you file for yourself, you may check your appeal's status on-line at any time. You may also look up the status of appeals for past tax years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.