Loading

Get Tax Status Change Acknowledgement (nn1660e). Complete This Form To Request A Change To A Permanent

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Status Change Acknowledgement (NN1660E) online

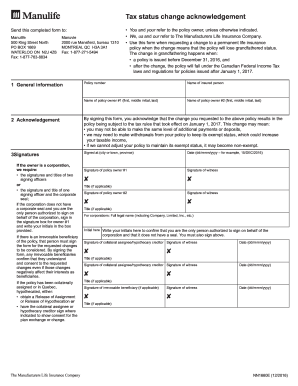

The Tax Status Change Acknowledgement (NN1660E) is a crucial document used to request a change to a permanent life insurance policy, particularly when it may lose its grandfathered status under Canadian tax laws. This guide will help you navigate the process of completing this form efficiently and effectively.

Follow the steps to complete the Tax Status Change Acknowledgement form online.

- Click the ‘Get Form’ button to download the Tax Status Change Acknowledgement (NN1660E) form and open it in your preferred document editor.

- Begin by providing the necessary general information. Enter your policy number and the name of the insured person. Fill in the names of the policy owners (both owner #1 and owner #2) including first names, middle initials (if applicable), and last names.

- In the acknowledgement section, review the implications of the requested change. Understand that by signing the form, you acknowledge that the policy will be subject to the new tax rules effective January 1, 2017. Be aware of how these changes could affect your ability to make additional payments or the potential for increased taxable income.

- Proceed to the signatures section. Indicate the city or town and province where you are signing the document. Fill in the date in the specified format (dd/mmm/yyyy). Ensure that policy owner #1 signs the form, and provide a signature for the witness as well.

- If the policy is owned by a corporation, ensure that the required signatures and titles of signing officers are included. If there is no corporate seal, the authorized person should sign in the box for owner #1 and initial the confirmation.

- If there is an irrevocable beneficiary, their signature is required for the changes to be valid. Confirm that the beneficiary understands and consents to the changes by having them sign the appropriate area.

- If the policy has a collateral assignment or if it is hypothecated, obtain the necessary release or get the collateral assignee's signature. This ensures that any consent required for adjustments is documented.

- After completing the form, review all sections to ensure accuracy. Save any changes you've made, and consider downloading, printing, or sharing the completed form as necessary.

Complete your Tax Status Change Acknowledgement (NN1660E) online today to ensure a smooth transition for your policy changes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.