Loading

Get Bank Form - Ptet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bank Form - PTET online

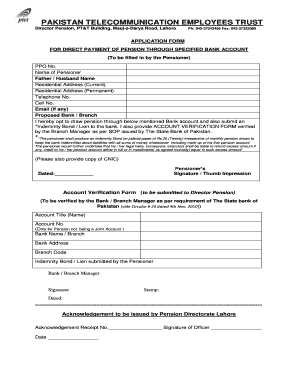

Filling out the Bank Form - PTET online can simplify the process of directing your pension payments to your chosen bank account. This guide provides step-by-step instructions to help you accurately complete the form.

Follow the steps to complete the Bank Form - PTET online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Enter your PPO number in the designated field. This is essential for processing your pension application.

- Fill in your name as the pensioner. Ensure that this matches the name on your identification documents.

- Provide the name of your father or partner in the specified section. This is important for identity verification.

- Indicate your current residential address in the respective field. Accuracy is important for correspondence related to your pension.

- Input your permanent residential address, if different from your current address.

- Enter your telephone number and cell number for contact purposes.

- If you have an email address, provide it in the specified field. This may facilitate communication regarding your pension.

- Identify your chosen bank and branch for pension disbursement in the relevant section.

- You must opt to draw your pension through the mentioned bank account and acknowledge that you will submit an indemnity bond to the bank.

- Ensure that you provide the required ACCOUNT VERIFICATION FORM, which must be verified by the Branch Manager, as per the State Bank of Pakistan's Standard Operating Procedures.

- Affix your signature or thumb impression in the space provided at the bottom of the form.

- Review all entries for accuracy and completeness before finalizing.

- Finally, save changes, and you can download, print, or share the completed form as needed.

Complete your Bank Form - PTET online today to ensure timely processing of your pension payments.

Who is eligible? Filing statusRecomputed federal adjusted gross incomeSingle$12,500 or lessMarried filing jointly Head of household with qualifying person Qualifying surviving spouse$22,500 or lessMarried filing separatelySee instructions for Form IT-201 or instructions for Form IT-360.1. Mar 13, 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.