Loading

Get Tax Exempt Form Wayne State University

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Exempt Form Wayne State University online

Filling out the Tax Exempt Form Wayne State University online is a straightforward process that enables users to claim exemption from sales and use tax. This guide will walk you through each section of the form, ensuring you complete it accurately to meet your tax exemption needs.

Follow the steps to complete your Tax Exempt Form online.

- Press the ‘Get Form’ button to access the Tax Exempt Form and open it for editing.

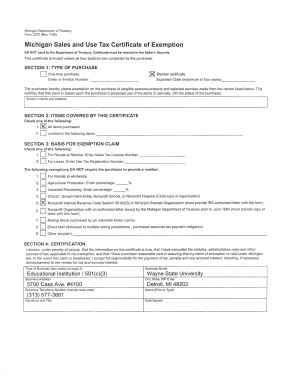

- In Section 1, specify the type of purchase by selecting either 'One-time purchase' or 'Blanket certificate.' If you choose the latter, include an expiration date that should not exceed four years. Additionally, provide the vendor's name and address.

- Proceed to Section 2 and indicate the items covered by this certificate. You can either check 'All items purchased' or specify 'Limited to the following items' if applicable.

- In Section 3, choose the basis for your exemption claim by checking the relevant box. You may need to enter specific numbers, such as your Sales Tax License Number or Use Tax Registration Number where required. For certain exemptions that do not require a number, ensure you check the corresponding box.

- Complete Section 4 by providing a declaration of the truthfulness of the information on the certificate. Fill in your business name, address, telephone number, and the printed name of the person completing the form. Ensure you sign and date the certificate.

- Once you have filled out all sections completely, you can save the changes, download a copy, print the form for your records, or share it as needed.

Complete your Tax Exempt Form online today to claim your exemption efficiently.

2022-23 FAFSA Apply for fall 2022, winter 2023 and spring/summer 2023 semesters. 2023-24 FAFSA Apply for fall 2023, winter 2024 and spring/summer 2024 semesters. Use the WSU School Code 002329. Use the IRS Data Retrieval tool to transfer your tax data directly onto your FAFSA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.