Loading

Get Donation Form: Donor Faqs Tax Credit Program

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DONATION FORM: DONOR FAQs Tax Credit Program online

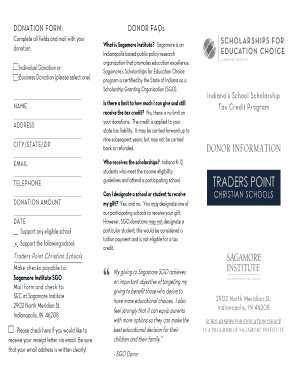

Filling out the DONATION FORM for the Tax Credit Program is a simple yet important process that allows individuals and businesses to support educational opportunities in Indiana. This guide provides you with clear, step-by-step instructions to successfully complete the form online.

Follow the steps to fill out the donation form accurately.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Select whether you are making an individual or business donation by marking the appropriate checkbox.

- Complete the donor information section by filling in your name, address, city, state, zip code, email, and telephone number.

- Indicate your donation amount and the date of the donation in the specified fields.

- Support either any eligible school or select a specific school by marking the provided options accordingly.

- To receive a receipt letter via email, check the designated box and ensure your email address is clearly written.

- Once all fields are completed, review your information for accuracy, then save your changes.

- Download, print, and share the completed form as needed, and ensure it is mailed along with your donation check.

Start filling out your donation form online to make a difference in the education choices for Indiana families.

For any contribution of $250 or more (including contributions of cash or property), you must obtain and keep in your records a contemporaneous written acknowledgment from the qualified organization indicating the amount of the cash and a description of any property other than cash contributed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.