Loading

Get Md Fannie Mae/freddie Mac Form 3021 2001-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Fannie Mae/Freddie Mac Form 3021 online

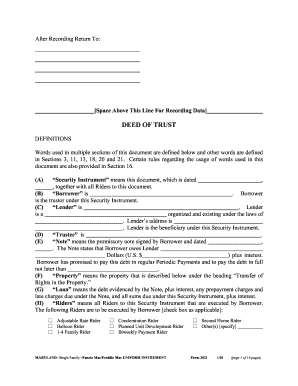

Filling out the MD Fannie Mae/Freddie Mac Form 3021 is an essential step in securing your loan and ensuring that all parties involved are aware of their rights and obligations. This guide provides clear and supportive instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the MD Fannie Mae/Freddie Mac Form 3021 online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- In the first section, date the document and fill in the borrower's name. This helps establish the identity of the parties involved in the mortgage transaction.

- Next, provide the lender's name, organizational status, and address. Ensure this information is accurate, as it is critical for contract enforcement.

- Indicate the trustee's name. This person or entity will hold the title to the property until the debt is paid off.

- In the sections regarding the Note, specify the amount owed and the interest rate. Include details about payment schedules to ensure clarity on financial obligations.

- Describe the property involved by providing its address, including city and zip code. This will help clarify what asset is being secured by the loan.

- Check the applicable Riders that pertain to the loan, such as Adjustable Rate Rider or Condominium Rider. This is important for determining additional terms and conditions.

- Complete any additional sections as directed in the form, ensuring all necessary details are accurately filled in.

- Once you have reviewed all information for accuracy, save the changes. You can then download, print, or share the finalized form as required.

Complete your forms online with confidence, ensuring all details are accurate and well-documented.

Yes, Freddie Mac remains an active player in the housing finance market. It continues to support affordable housing by purchasing and securitizing mortgages. For homeowners looking to understand their options, the MD Fannie Mae/Freddie Mac Form 3021 will help clarify Freddie Mac's role and benefits in obtaining financing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.