Loading

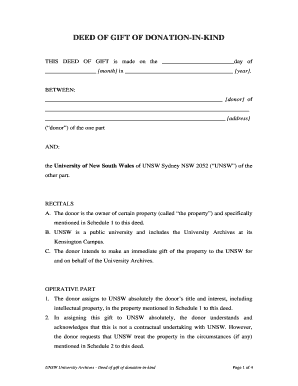

Get Deed Of Gift Of Donation-in-kind - University Of New South Wales - Recordkeeping Unsw Edu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Deed Of Gift Of Donation-in-kind - University Of New South Wales - Recordkeeping Unsw Edu online

Filling out the Deed Of Gift Of Donation-in-kind for the University of New South Wales can feel daunting, but with careful attention to each section, you can complete it efficiently. This guide provides a step-by-step approach to ensure that you understand every component of the form.

Follow the steps to complete the Deed Of Gift Of Donation-in-kind form effortlessly.

- To begin, locate the Deed Of Gift Of Donation-in-kind form online. Click the ‘Get Form’ button to access the document and open it using your preferred editor.

- Fill in the date on the first line, indicating the day, month, and year the deed is made. Be sure to write this clearly to avoid any misunderstandings.

- Next, enter the full name of the donor in the space provided. This identifies the individual or entity making the donation.

- In the address section, provide the complete address of the donor. This is essential for contact purposes.

- After completing the donor's details, confirm the title and interest in the property being donated. Make sure that all relevant items are listed accurately in Schedule 1, as this section outlines the specific goods being contributed.

- Proceed to Schedule 2 to include any requests regarding the treatment of the donated property, if applicable. This allows the donor to stipulate considerations for the care and use of the items.

- Sign the document in the designated area for the donor's signature. Ensure this is done in the presence of a witness who will also sign and provide their printed name.

- The form requires a signature from an authorized person at UNSW. After their signature, a witness must also sign, along with their printed name.

- Once all sections are completed and signed, review the document for accuracy. After ensuring that everything is correct, you can save the changes, download it for your records, or print and share it as needed.

Complete your Deed Of Gift Of Donation-in-kind online today to ensure your generous donation is processed smoothly.

How to provide an in-kind donation receipt? In the case of in-kind donations exceeding $250, donors need to determine the deductibility of the items themselves. In that case, all you need to provide in the donation receipt is the name and EIN of the organization, date of donation, and a description of the donated item.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.