Loading

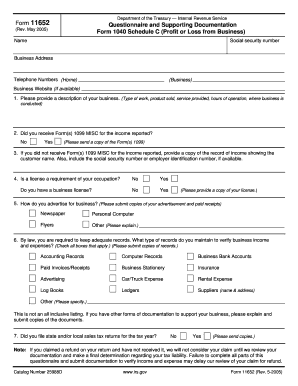

Get Form 11652 (rev. 5-2005). Questionnaire Form 1040 Schedule C (profit And Loss From Business)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 11652 (Rev. 5-2005). Questionnaire Form 1040 Schedule C (Profit And Loss From Business) online

Filling out the Form 11652 is an essential step for reporting your business income and expenses to the Internal Revenue Service. This guide will provide you with clear, step-by-step instructions to help you complete the form efficiently and accurately.

Follow the steps to complete your Form 11652 online.

- Press the ‘Get Form’ button to acquire the form and open it in your editing application.

- Begin by entering your name and social security number at the top of the form. It is crucial to input this information correctly to ensure proper identification.

- Provide your business address, including the street, city, state, and zip code. This information should reflect where your business operates.

- Next, list your telephone numbers: one for your home and one for your business. These will be used to contact you regarding your submission.

- If applicable, enter your business website. This should be the official site that represents your business online.

- Describe your business comprehensively. Detail the type of work you do, the products you sell, or the services you provide, along with your hours of operation and the location of your business activities.

- Indicate whether you have received Form(s) 1099 MISC for the income reported. If yes, be prepared to submit copies of these forms.

- If you did not receive Form(s) 1099 MISC, provide a record of your income showing customer names and any relevant social security or employer identification numbers.

- Answer whether a license is required for your profession and indicate if you possess a business license. If you do, provide a copy of that license.

- Describe your advertising methods. Submit copies of any advertisements and relevant receipts as evidence.

- Check all types of records you maintain to verify business income and expenses, such as accounting records, invoices, and bank statements. Include copies of these records.

- State whether you filed state and/or local sales tax returns for the tax year, and if so, submit copies of those returns.

- Finally, review all the information you have entered. Once satisfied, you can save the changes, download the completed form, print it, or share it as needed.

Complete your documents online today to ensure compliance and accuracy.

What's the Difference Between Form 1040 and Form 1099? The key difference between these forms is that Form 1040 calculates your tax owed or your refund. It includes multiple details about your personal tax situation. Forms 1099 report only one source of income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.