Loading

Get Monthly Payroll Summary

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MONTHLY PAYROLL SUMMARY online

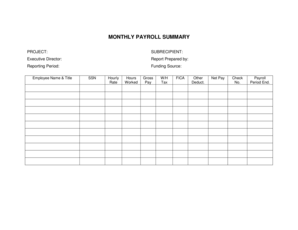

Filling out the Monthly Payroll Summary accurately is crucial for reporting employee compensation and ensuring compliance with payroll regulations. This guide provides a clear path to successfully completing the form online, making the process straightforward for all users.

Follow the steps to complete the Monthly Payroll Summary accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the project name in the designated field to specify the associated initiative.

- Fill in the subrecipient's name, which is the entity receiving funds for project implementation.

- Provide the name of the Executive Director responsible for overseeing the project.

- Indicate the name of the person preparing the report for accountability.

- Specify the reporting period by entering the start and end dates relevant to this summary.

- Identify the funding source to clarify where the financial resources originate.

- Enter the employee's name and title in the appropriate fields to highlight payroll entries.

- Record the employee’s Social Security Number (SSN) carefully for identification purposes.

- Input the hourly rate that the employee is compensated based on their role.

- Document the total hours worked by the employee during the reporting period.

- Calculate the gross pay by multiplying the hourly rate by the hours worked.

- Provide the withholding tax by determining the necessary deductions based on applicable tax rates.

- Enter the FICA amount, which includes Social Security and Medicare taxes.

- If applicable, list any other deductions that should be subtracted from the gross pay.

- Calculate and input the net pay after all deductions have been accounted for.

- Assign the check number corresponding to the payment made to the employee.

- Indicate the payroll period end date to clearly define the timeframe of this payroll summary.

- Once all fields are filled out accurately, review the form for any errors, then save your changes. You can download, print, or share the form as needed.

Take the next step and complete your Monthly Payroll Summary online today.

Standard Month End Reports Your last payroll for the month is any payroll where the number of days in the paycycle is greater than the number of days left in the current month. For example, if you are running a weekly payroll, your month end reports will generate when there are less than 7 days left in the month.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.