Loading

Get Gst191e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst191e online

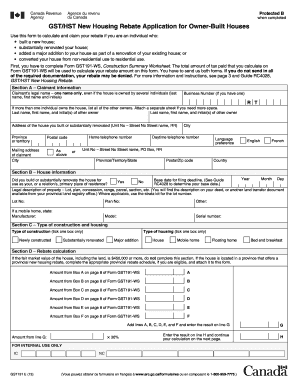

The Gst191e form is essential for individuals claiming the GST/HST new housing rebate after building a new home or making significant renovations. This guide provides a clear, step-by-step approach to filling out the form accurately online.

Follow the steps to complete the Gst191e form online successfully.

- Click ‘Get Form’ button to access the Gst191e form and open it in your browser.

- Provide your claimant information in Section A. List your legal name, business number if applicable, and any other co-owners' details. Include the address of the completed construction and contact information.

- In Section B, answer if you built or renovated the house for primary residency and provide the base date for the filing deadline.

- Fill out Section C by selecting the type of housing and type of construction. Ensure to tick only one box for each.

- Proceed to Section D for rebate calculations. Enter amounts from the Construction Summary Worksheet (Form GST191-WS) and perform the necessary calculations based on the guidelines provided.

- Continue with any calculations in Section D as necessary, especially if different GST/HST rates were applied.

- Complete Section E by certifying that the information is true and provide your signature, date, and any attached power of attorney if applicable.

- If you wish to have your refund directly deposited, fill out Section F with your banking details.

- Once you have completed all sections, review the form for accuracy. You can then save any changes, download the completed form, print it, or share it as required.

Start filling out the Gst191e form online today to ensure you get your housing rebate!

Provincial Tax Credit Program A provincial tax credit may be applied to the provincial portion of property tax on non-commercial property. Currently, the provincial tax credit is $0.50 per $100 of taxable valuable assessment. Who is eligible? You may qualify for the provincial tax...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.