Get Hi Form 14 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI Form 14 online

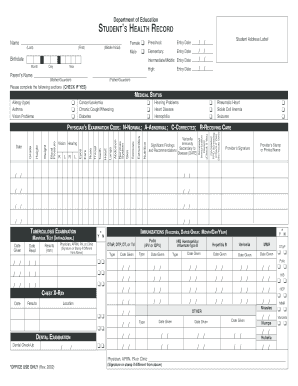

Completing the HI Form 14 online is essential for documenting a student's health record for school entry. This guide provides simple, step-by-step instructions to help ensure that the form is filled out accurately and efficiently.

Follow the steps to complete the HI Form 14 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the student’s name in the designated fields for last name, first name, and middle initial. Ensure you check the appropriate box to indicate their gender.

- Input the student’s birthdate by selecting the month, day, and year from the date fields provided.

- Enter the parent's name, indicating if it is the mother/guardian or father/guardian.

- Fill in the student address label, ensuring all sections including street, city, state, and ZIP code are completed.

- In the medical status section, check the relevant medical issues by selecting 'Yes' or leaving it unchecked for 'No'.

- For each medical condition listed, provide further information as required, including any allergies or chronic conditions.

- Obtain the provider’s stamp or printed name along with their signature confirming the health examination results.

- Complete the immunization section by documenting the vaccines received along with their respective dates; ensure to check the appropriate boxes.

- Make sure to document any significant findings and recommendations in the health history comments section.

- Once all sections are complete, review the form for accuracy. Finally, save your changes and choose to download, print, or share the form as needed.

Start filling out the HI Form 14 online today to ensure all necessary health records are documented accurately.

Get form

Related links form

If you fail to make the required Electronic Funds Transfer (EFT) payments in Hawaii, you may incur a penalty. Typically, this penalty is a percentage of the unpaid tax and can increase with repeated offenses. To avoid these penalties, it is crucial to understand your obligations and ensure timely payment. Utilizing resources like the uslegalforms platform can help you navigate these requirements seamlessly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.