Loading

Get Form L-4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form L-4 online

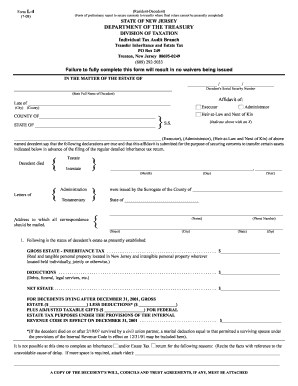

Filling out Form L-4 online is a crucial step in securing consents to transfer assets from an estate when a final return cannot be completed. This guide will help you navigate through each section of the form with clarity and support.

Follow the steps to successfully complete the online Form L-4.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering the decedent's full name and Social Security number in the specified fields.

- Indicate your role related to the decedent by selecting 'Executor', 'Administrator', or 'Heir-at-Law and Next of Kin' with an 'X'. Then, provide the city and county where the decedent lived.

- Select whether the decedent died testate (with a will) or intestate (without a will), and include the date of death (month, day, year).

- Provide the name and phone number of the person to whom all correspondence should be sent, along with their address (including street, city, state, and zip code).

- Detail the status of the decedent's estate by filling in the gross estate value, deductions, and net estate amount in the provided fields. If applicable, address the adjusted taxable gifts for federal estate tax purposes.

- Explain the reasons for any delays in completing a detailed inheritance or estate tax return, using the text box provided. Attach additional documentation if necessary.

- Document any transfers of property made by the decedent that did not receive full financial consideration, including details such as dates and names of transferees.

- List any New Jersey real estate owned by the decedent, including assessed and market values, along with information on any encumbrances.

- Record details of any stocks, bonds, or brokerage accounts held in the decedent's name, indicating market value and any relevant pledges.

- Fill out information regarding bank accounts in New Jersey, including the name of the bank, date of death, balance at death, current balance, and any co-depositors.

- Identify the relationship of survivors who are entitled to share in the estate, including their names, addresses, relationships, and ages of life tenants.

- Request waivers for the necessary items, attaching a list of assets held in custodial accounts if applicable.

- Acknowledge your willingness to make any necessary payment as determined by the Inheritance Tax Branch to ensure the transfer consents.

- After completing all sections, review the form for accuracy, then save your changes. You can download, print, or share the completed form as needed.

Complete your Form L-4 online today to ensure a smooth estate transfer process.

The LA Department of Revenue Account Number for the Business can be found on the first page of your Louisiana income tax return, Louisiana sales tax return, or Louisiana employer withholding form. The format for the account # is #######-001 for Partnerships, LLCs, and Corporations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.