Loading

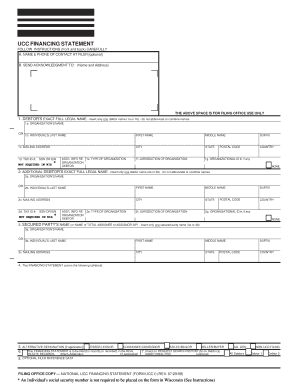

Get National Ucc Financing Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the National Ucc Financing Statement online

The National Ucc Financing Statement (Form UCC1) is a crucial document for securing interests in collateral. This guide provides step-by-step instructions to help users complete the form accurately and efficiently, especially when filing online.

Follow the steps to fill out the National Ucc Financing Statement online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the debtor's exact full legal name in the designated space. Ensure you input only one debtor name, either as an organization or individual, and refrain from abbreviating or combining names.

- Provide the mailing address for the debtor. It's important that this information is complete and correctly formatted.

- Fill in the tax identification number, which can be the Social Security Number or Employer Identification Number, if required by your jurisdiction.

- Complete any additional information regarding the organization, such as the type of organization and jurisdiction of organization.

- If applicable, add details for any additional debtors, ensuring to follow the same format as used for the first debtor.

- List the secured party's name accurately; this information is crucial for establishing the security interest.

- Describe the collateral covered by this Financing Statement, using additional pages if necessary to provide complete information.

- Select the appropriate designation for the transaction type, such as lessee/lessor or consignee/consignor, if needed.

- If you wish to request a search report on the debtors, check the appropriate box and be aware that an additional fee may apply.

- Review all provided information for accuracy. Once completed, save your changes, and you'll have the option to download, print, or share the form.

Complete your National Ucc Financing Statement online today to ensure your financing interests are properly secured.

Generally speaking, lenders will mostly file UCC liens on property or real estate or any other business assets. If you fail to pay your debt, a judgment creditor can usually seize cash from your bank account or force the sale of most business assets.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.