Loading

Get Dtf 973

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dtf 973 online

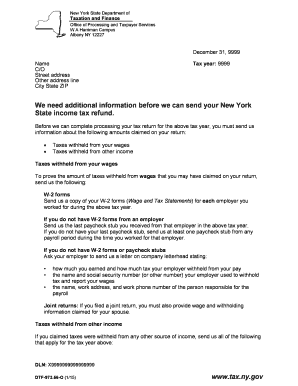

The Dtf 973 form is a crucial document for individuals in New York State seeking their income tax refund. This guide provides clear and comprehensive steps for users to accurately fill out the Dtf 973 online, ensuring all necessary information is provided for timely processing.

Follow the steps to successfully complete the Dtf 973 online.

- Click the ‘Get Form’ button to obtain the Dtf 973 and open it in your preferred online editor.

- Enter your name in the designated field at the top of the form, along with your tax year.

- Provide your street address, city, state, and ZIP code in the respective fields to ensure accurate identification.

- You must provide documentation of taxes withheld from your wages. Attach W-2 forms from each employer you worked for during the tax year.

- If W-2 forms are unavailable, attach your last paycheck stub from the respective employer or at least one stub from any payroll period during your employment.

- In cases where W-2 forms or paycheck stubs are not available, request your employer to provide a letter on company letterhead detailing your earnings and the amount of tax withheld.

- Complete the section for taxes withheld from other income. Attach relevant documents such as Form 1099-R, Form 1099-MISC, Form 1099-G, or any other form verifying tax withheld.

- Ensure you have included all necessary wage and withholding information if you filed a joint return, including details for your spouse.

- Review all entered information for accuracy, and once satisfied, save changes and choose to download, print, or share the completed form as necessary.

Complete your Dtf 973 form online today and ensure your tax refund is processed promptly.

Similar to federal income taxes, states generally impose income taxes on your earnings if you have a sufficient connection to the state or if you earned income in the state even without sufficient connections. So, if you earn an income or live in NY, you must pay NY state tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.