Loading

Get 263a Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 263a Form online

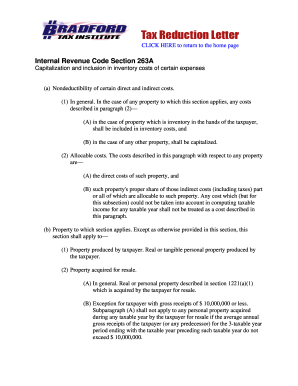

Filling out the 263a Form correctly is vital for ensuring compliance with the Internal Revenue Code Section 263A. This guide offers clear, step-by-step instructions to support you in completing the form efficiently online.

Follow the steps to fill out the 263a Form online.

- Click the ‘Get Form’ button to access the 263a Form and open it in your online editor.

- Begin by reviewing the form's introductory section to understand its purpose and the significance of capitalization and inclusion in inventory costs.

- In the primary section of the form, provide the required information regarding any property that applies under this section, including descriptions of direct and indirect costs.

- Enter the appropriate figures for any allocable costs, ensuring that you accurately categorize them as direct or indirect.

- Complete any necessary fields regarding exemptions, including personal use property, research and experimental expenditures, and development costs related to oil and gas wells.

- If applicable, address any exceptions for farming businesses by specifying the related property details.

- Review the definitions and any specific rules outlined for the particular categories or options chosen on your form.

- Finalize your completion of the form by saving your changes, and you can choose to download, print, or share the form as needed.

Start filling out the 263a Form online today for a seamless filing experience.

The Section 263A UNICAP rules require businesses to capitalize the direct and indirect costs associated with producing, acquiring, and maintaining their inventory. In general, Section 263A applies to real or personal property produced by a taxpayer and real or personal assets acquired by a taxpayer for resale.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.