Loading

Get Ca De 4 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA DE 4 online

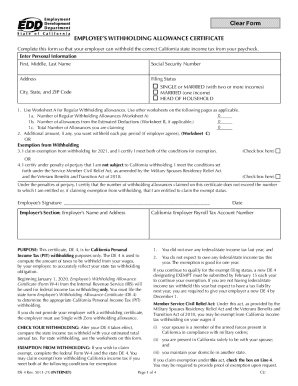

The CA DE 4 is an essential form for California workers to inform their employers about state income tax withholding. This guide provides clear instructions for completing the form online, ensuring that you can accurately report your withholding allowances and tax obligations.

Follow the steps to complete your CA DE 4 form online.

- Press the ‘Get Form’ button to access the CA DE 4 form and open it in your preferred editor.

- Enter your personal information, including your first, middle, and last name, Social Security number, and your current address, along with city, state, and ZIP code.

- Select your filing status among the options provided: SINGLE or MARRIED (with two or more incomes), MARRIED (one income), or HEAD OF HOUSEHOLD.

- Use Worksheet A to calculate the number of regular withholding allowances you wish to claim. Fill in the appropriate sections by entering the number of allowances for yourself, spouse, and dependents.

- Complete the additional sections if you wish to claim any exemptions from withholding or additional amounts to be withheld each pay period.

- Sign the form in the designated area under penalties of perjury, certifying that the information provided is accurate and truthful.

- At the end of the form, review all entered information for accuracy. Once satisfied, you can save your changes, download the completed form, print a copy, or share as needed.

Start filling out your CA DE 4 form online today to ensure proper state tax withholding!

Does everyone have to complete a new Form W-4? No. You're required to complete the new form only if you're hired by a new employer in 2020 or if you want to have more (or less) money withheld from your paycheck perhaps because of a life change, like getting married or having a baby.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.