Loading

Get Sba Application Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sba Application Forms online

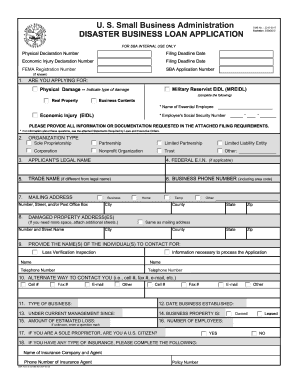

Filling out the Sba Application Forms online can be a straightforward process when you have a clear understanding of each section. This guide aims to provide a comprehensive overview of the application components, empowering users to complete their application with confidence and accuracy.

Follow the steps to successfully complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the first section, where you indicate the type of assistance you are applying for. Carefully choose from the options such as Military Reservist EIDL or Economic Injury, ensuring to provide additional details if necessary.

- In the organization type section, select the appropriate category for your business, which includes sole proprietorship, partnership, corporation, or nonprofit, among others.

- Enter the applicant's legal name in the designated field, followed by your federal Employer Identification Number (E.I.N.) if applicable.

- Fill out the trade name, if it differs from the legal name, and provide a business phone number including the area code.

- Complete the mailing address section accurately, followed by the details of any damaged property if relevant.

- Provide contact information for individuals who can assist with loss verification and application processing.

- Specify your alternate contact method such as cell phone, fax, or email for further communication.

- Indicate the type of business and provide the date it was established, along with details regarding its current management period.

- Estimate and enter the amount of loss sustained and the total number of employees at your business.

- If you are a sole proprietor, confirm U.S. citizenship by selecting ‘Yes’ or ‘No’.

- Provide insurance details if applicable, including your insurance company's name, agent's contact information, and policy number.

- Fill out the owners' section with information for each individual holding a significant stake or office in the business.

- Address any questions regarding bankruptcy or other financial issues as required in the application.

- If applicable, for physical damage loans, indicate interest in considering additional funds for mitigating measures in the future.

- If an assistant helped you, ensure they sign the application. Provide their name, company name, and contact information.

- Read through the agreements and certifications section carefully. Confirm all statements are true and provide your signature and title.

- Finally, review all completed sections for accuracy. You can save your changes, download the form for your records, print it, or share it as necessary.

Complete your application online to take the first step towards securing financial assistance.

The minimum credit score required for an SBA loan depends on the type of loan. For SBA Microloans, the minimum credit score is typically between 620-640. For SBA 7(a) loans, the minimum credit score is typically 640, but borrowers may find greater success if they can boost their credit score into the 680+ range.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.