Loading

Get G-4 Form (georgia State Tax Withholding Allowance) - Hr Vanderbilt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the G-4 Form (Georgia State Tax Withholding Allowance) - Hr Vanderbilt online

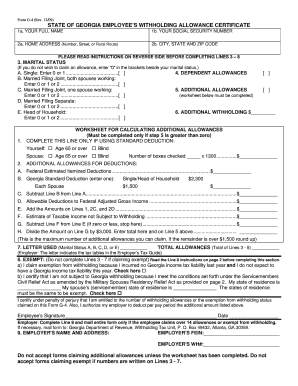

Filling out the G-4 Form is an important step in managing your state tax withholding. This guide will walk you through the process of completing the Georgia State Tax Withholding Allowance Form, providing clear instructions to ensure accuracy.

Follow the steps to complete the G-4 Form effectively

- Press the ‘Get Form’ button to access the G-4 Form and display it in your editor.

- Enter your full name in Box 1a. Make sure to provide accurate spelling to avoid any issues.

- Input your Social Security number in Box 1b. Ensure that this number is correct, as it is vital for your tax records.

- In Box 2a, fill in your home address, including the house number and street name.

- Complete Box 2b by providing your city, state, and ZIP code information.

- On Line 3, select your marital status and enter the corresponding number of allowances in the brackets provided.

- For Line 4, enter the number of dependent allowances you are claiming. Make sure this is accurate to reflect your situation.

- If applicable, complete Line 5 by using the worksheet provided to calculate any additional allowances. Input the result on this line.

- On Line 6, specify an additional dollar amount you wish to withhold, if any.

- In Line 7, write down the letter corresponding to your marital status from Line 3, and calculate the total allowances from Lines 3 to 5.

- If claiming exempt, complete Line 8, either by checking the box for exemption or providing the necessary information for the Military Spouses Residency Relief Act.

- Finally, sign and date the form at the end to validate your submission.

- Review all the entered information carefully before saving your changes, downloading, or printing the completed form.

Complete your G-4 Form online today for accurate state tax withholding management.

You claim one allowance for yourself if you're being claimed as a dependent on anyone else's tax return. You then add more allowances as you go down a list of conditions. For example, if you're single with only one job, or married with a non-working spouse, you add another allowance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.