Loading

Get Tractor Loan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tractor Loan online

Applying for a tractor loan online can seem overwhelming, but this guide will help you navigate each step with ease. By following these detailed instructions, you will be well-prepared to complete your application accurately and efficiently.

Follow the steps to complete your Tractor Loan application online.

- Press the ‘Get Form’ button to access the Tractor Loan application and open it for editing.

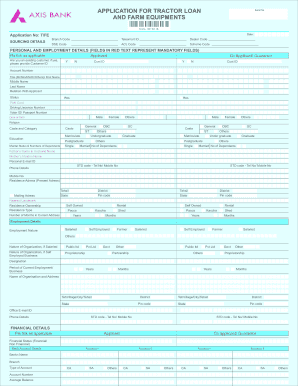

- In the sourcing details section, fill in the branch code, telesmart ID, dealer code, DSE code, ACL code, and scheme code, as appropriate.

- Complete the personal and employment details section. Ensure to fill in all mandatory fields marked in red. Indicate if you are an existing customer and provide your customer ID if applicable.

- Provide your and any co-applicant's personal information, including full names, titles, date of birth, religion, education, marital status, and contact information.

- In the employment details section, indicate your employment status. If applicable, specify the nature of your organization and designation, along with your employment duration.

- Detail your financial status. Complete the bank account details for both the applicant and co-applicant, and include existing loan details if applicable.

- Fill out the tractor and equipment loan section, specifying asset details, including model, cost, and required loan amount.

- Review the declaration regarding your relationship with bank directors. Ensure you select yes or no as required and provide any necessary details.

- Finally, attach any required documents as outlined in the application checklist, such as identity proof and financial statements.

- Once all fields are completed and documents uploaded, you can save your changes, download a copy of the application, print it, or share it as needed.

Start your Tractor Loan application online today and secure the funding you need!

Types of Ag Equipment Financing Purchase, lease and refinance options available on new and used ag equipment sold through farm equipment dealers — with 2-7 years (up to 10-year term on pivots)*.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.