Loading

Get Nc State W 9 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nc State W 9 Form online

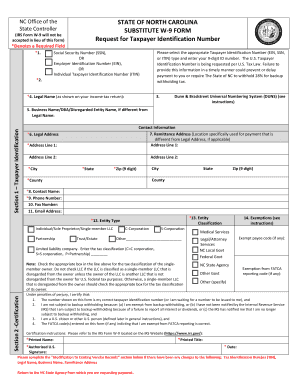

The Nc State W 9 Form is a request for taxpayer identification number required for various business transactions within the State of North Carolina. This guide will provide you with clear, step-by-step instructions on how to accurately fill out this form online, ensuring compliance and efficiency.

Follow the steps to complete the Nc State W 9 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, provide your Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN) in the designated field. Remember, this is a required field.

- Next, enter your legal name exactly as it appears on your income tax return in the Legal Name field.

- If your business name is different from your legal name, include it in the Business Name/DBA field.

- Input your legal address in the designated fields. Ensure you fill in Address Line 1, and provide Address Line 2 if necessary, along with your city, state, and zip code.

- For your contact information, provide the remittance address if it differs from your legal address. This is where you will receive payments.

- Complete the contact information fields by entering your contact name, phone number, fax number (if applicable), and email address.

- Select your entity type and classification in the Entity Type and Entity Classification sections. Ensure you choose the correct options to avoid possible issues.

- If applicable, indicate any exemptions from backup withholding and FATCA reporting in the corresponding field.

- Review all entered information for accuracy and completeness before proceeding to certification.

- In the certification section, read the statement provided and confirm your understanding. Then, print your name, provide your signature, and date the form.

- Finally, you can save changes, download a copy of the form, print it, or share it as necessary.

Complete the Nc State W 9 Form online today to ensure timely processing of your business transactions.

What Form Should I File? All individuals (including part-year residents and nonresidents) required to file a North Carolina individual income tax return must file Form D-400.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.