Loading

Get Ifta Quarterly Statement Blank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IFTA Quarterly Statement Blank online

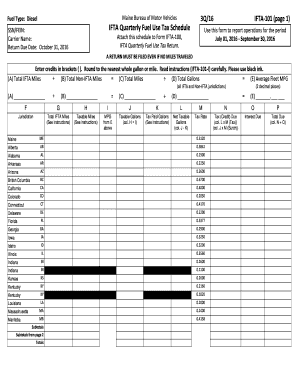

The IFTA Quarterly Statement Blank is an essential document for reporting fuel use for carriers operating under the International Fuel Tax Agreement. This guide will help you navigate the form step-by-step to ensure accurate completion.

Follow the steps to fill out your IFTA Quarterly Statement Blank online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the designated field. This information helps identify your account and ensures accurate processing.

- Provide your carrier name in the specified space. This should match the registered name associated with your IFTA license.

- Indicate the return due date, making sure it reflects the correct deadline for the reporting period, which is October 31 for the current quarterly report.

- Complete the operational periods, which cover the fiscal quarter from July 01 to September 30, and ensure this timeframe is correctly reflected on the form.

- Fill out the total miles traveled by entering data into Columns A, B, and C. This includes total IFTA miles, total non-IFTA miles, and a calculated field for total miles.

- Input the total gallons of fuel in column D and determine your average fleet miles per gallon (MPG) to be recorded in column E.

- For each jurisdiction you operated in, provide details in the subsequent columns about taxable miles, gallons used, and applicable tax rates.

- After completing all fields, ensure you double-check the figures for accuracy, especially the totals calculated from column values.

- Once all fields are filled correctly, save your changes, and download the form for your records. You may also print or share the form as necessary.

Complete your IFTA Quarterly Statement Blank online today for efficient and accurate filing!

If you use any private delivery service, whether it is a designated service or not, send the form(s) covered by these instructions to: NYS Tax Department, IFTA Registration, 90 Cohoes Ave, Green Island NY 12183-1515.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.