Loading

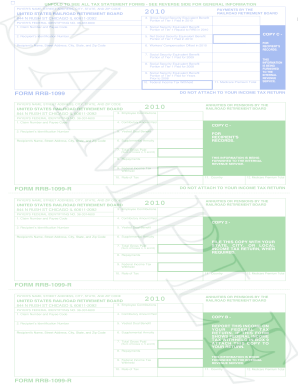

Get Rrb 1099

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rrb 1099 online

The Rrb 1099 form is an essential document used to report income from the Railroad Retirement Board. Filling it out accurately is important for both tax reporting and personal records. This guide will provide clear, step-by-step instructions to help you complete the form online effectively.

Follow the steps to complete the Rrb 1099 online.

- Access the Rrb 1099 form by clicking the ‘Get Form’ button to download and open it in your online editor.

- Begin filling out the form by entering the payer's name, address, and federal identifying number located at the top of the form.

- In section one, input your claim number and payee code, as these identifiers are important for record-keeping.

- Next, provide the recipient’s identification number, ensuring it is accurate to avoid issues with tax reporting.

- Move on to the income sections, including the gross social security equivalent benefit and the net social security equivalent benefit fields. Fill in the amounts as applicable.

- Complete sections for any repayments or offsets, including workers’ compensation offset or any other relevant adjustments.

- In the federal income tax withheld section, if applicable, list any federal taxes that have been withheld during the year.

- Ensure to review all entries for accuracy, then choose to save your changes, download the completed form, print it, or share it as needed.

Start filling out your Rrb 1099 online today for smooth tax processing.

The railroad retirement tier I tax rate is the same as the social security tax, and for withholding and reporting purposes is divided into 6.20 percent for retirement and 1.45 percent for Medicare hospital insurance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.