Loading

Get Emerchant Processing Conversion Bonus Request Form 2006-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EMerchant Processing Conversion Bonus Request Form online

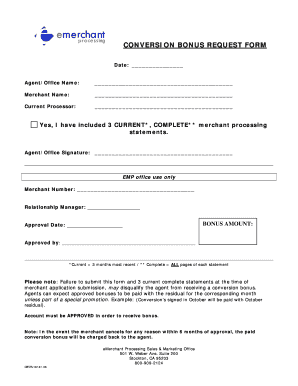

Filling out the EMerchant Processing Conversion Bonus Request Form online is an essential step for agents seeking to request a conversion bonus. This guide provides clear and accessible instructions to help users successfully complete and submit the form.

Follow the steps to fill out the form accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'Date' field, enter the current date when submitting the form.

- Fill in the 'Agent/Office Name' field with your full name or the name of the office you represent.

- In the 'Merchant Name' section, enter the legal name of the merchant associated with this request.

- Provide the name of the 'Current Processor' facilitating the merchant's transactions.

- Confirm that you have included three current and complete merchant processing statements by checking the provided box.

- Sign the form in the 'Agent/Office Signature' field to validate your request.

- For internal use, ensure the fields 'Merchant Number', 'Relationship Manager', and 'Approval Date' are left blank for EMP office staff to fill in.

- Fill in the 'BONUS AMOUNT' section only if required, as this will be finalized upon approval.

- After completing all fields, review the form for accuracy. Save changes, then download, print, or share the completed document as needed.

Complete your EMerchant Processing Conversion Bonus Request Form online today for a seamless submission process.

Since the IRS views bonuses as supplemental income, employers must withhold taxes on bonuses ing to IRS regulations for supplemental income, which is a separate withholding calculation than your regular wage or salary pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.