Loading

Get Ne Form 521 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE Form 521 online

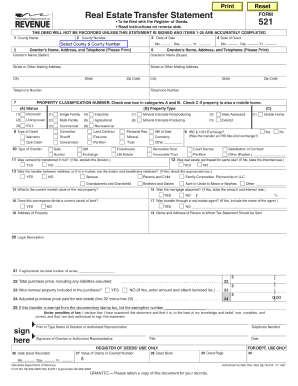

Filling out the NE Form 521 online is an essential step for recording real estate transactions in Nebraska. This guide provides a comprehensive overview of each section and field in the form, ensuring you understand the requirements and can complete it accurately and efficiently.

Follow the steps to complete the NE Form 521 online

- Press the ‘Get Form’ button to access the online form and open it in your preferred editor.

- In Section 1, enter the name of the county where the property is located.

- In Section 2, input the corresponding county number, which can be found on the Nebraska Department of Revenue website.

- For Section 3, state the date of sale.

- In Section 4, fill in the date of the deed, including month, day, and year.

- Complete Section 5 with the grantor’s name, address, and telephone number.

- In Section 6, provide the grantee’s name, address, and telephone number.

- For Section 7, check the relevant boxes for property classification, indicating status and property type.

- In Section 8, select the type of deed applicable to your transaction.

- Answer Yes or No in Section 9 if the property was purchased as part of an IRS like-kind exchange.

- Indicate the type of transfer in Section 10 by checking the appropriate box.

- Use Section 11 to clarify whether the ownership was transferred in full.

- In Section 12, indicate if the real estate was purchased for the same use.

- Fill in Section 13 to denote if the transfer was between relatives.

- Provide the current market value of the real property in Section 14.

- In Section 15, state whether the mortgage was assumed, including the amount and interest rate if applicable.

- Use Section 16 to indicate if the transfer divides the property.

- Input the property address in Section 18.

- In Section 19, provide the name and address for where the tax statement should be sent.

- Fill out the legal description in Section 20.

- For agricultural transactions, list the total number of acres in Section 21.

- Total the purchase price in Section 22, including all applicable costs.

- In Section 23, specify if any nonreal property was included in the purchase.

- Complete Section 24 with the adjusted purchase price.

- If applicable, enter the exemption number in Section 25.

- Ensure the form is signed in the authorized signature area, including the name and date.

- After completing the form, save your changes, and you can then download, print, or share the form as needed.

Complete your NE Form 521 online today to ensure a smooth transaction process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To properly fill out a quit claim deed, focus on accuracy and completeness. Begin with the NE Form 521, ensuring you list the grantor and grantee correctly, along with a precise property description. Complete all required signatures and have the deed notarized. Finally, file it with your local county office to finalize the transfer.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.