Loading

Get Nyc Rpie Faq 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC RPIE FAQ online

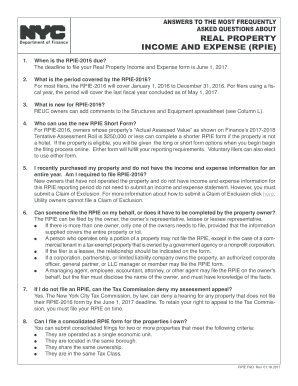

Filling out the New York City Real Property Income and Expense (RPIE) form can seem daunting. This guide provides you with step-by-step instructions to ensure a smooth and efficient online filing process.

Follow the steps to complete your RPIE FAQ submission

- Click the ‘Get Form’ button to obtain the RPIE FAQ document and open it for completing the necessary information.

- Fill out the first section of the form, ensuring to provide accurate property owner details and indicate whether the filing is being completed by the owner or their representative.

- In the subsequent section, enter the financial details covering the required income and expense periods. Note the deadlines and specific periods applicable based on your property's assessment.

- If applicable, choose the correct form based on your property’s Actual Assessed Value, considering options for long or short forms and meeting specific criteria as needed.

- Complete all relevant fields and double-check that the information corresponds to the correct borough, block, and lot number, as these details cannot be altered once submitted.

- Before submission, ensure that all required entries have been filled out accurately. Utilize the electronic signature option by clicking the 'Sign and Submit' button to finalize the submission.

- If you need to amend any entries after certification, re-enter the system with your password to make corrections prior to the June 1 submission deadline.

- Finally, after verifying the submission, you can save changes, download, print, or share the completed form as needed.

Take action now and complete your RPIE document online for a timely submission.

Filing Instructions: Utility Properties Visit the REUC-RPIE filing portal. ... Create a password for each property that you must file. ... Enter the requested information on each screen. You will be instructed to submit the application electronically.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.